Payroll System: It’s way more than just cutting checks, right? Think of it as the lifeblood of any company – the system that ensures everyone gets paid accurately and on time. This deep dive explores everything from the core functionalities and security measures to integration with other business apps and navigating the complexities of compliance. We’ll also cover cost analysis, reporting, training, and even troubleshooting those inevitable hiccups.

Get ready to level up your payroll game!

We’ll cover a wide range of topics, from understanding the different types of payroll systems (cloud-based vs. on-premise) and designing user-friendly interfaces to mastering data security and compliance regulations. We’ll also explore how to effectively integrate your payroll system with other essential business tools, like HR and accounting software, and how to optimize your system for scalability and flexibility as your company grows.

Finally, we’ll delve into the crucial process of vendor selection and troubleshooting common payroll issues.

Payroll System Features

A robust payroll system is the backbone of any organization’s financial health, ensuring accurate and timely compensation for employees while maintaining compliance with complex regulations. It’s more than just calculating wages; it’s a comprehensive suite of tools designed to streamline the entire payroll process, from data entry to report generation.Payroll systems handle a wide variety of tasks, minimizing errors and maximizing efficiency.

This allows HR and finance teams to focus on strategic initiatives rather than getting bogged down in administrative details.

Core Functionalities of a Payroll System

The core functionalities of a payroll system center around calculating employee compensation, managing tax deductions, and generating necessary reports. These systems typically handle gross pay calculations based on hourly rates, salaries, commissions, or bonuses. They automatically deduct taxes (federal, state, local), social security, and Medicare contributions, ensuring compliance with current tax laws. Furthermore, they facilitate the management of various deductions like health insurance premiums, retirement plan contributions, and other voluntary deductions.

Finally, they generate various reports, including pay stubs, payroll summaries, and tax forms (W-2s, 1099s), ensuring transparency and simplifying year-end tax filing.

Essential Modules of a Comprehensive Payroll System

A truly comprehensive payroll system extends beyond basic calculations. It incorporates several key modules to manage the entire payroll lifecycle effectively. These modules often include employee data management, where all employee information (personal details, compensation, tax information) is securely stored and updated. A time and attendance module tracks employee work hours, often integrating with biometric devices or time clocks for accurate record-keeping.

A benefits administration module handles the enrollment and management of employee benefits packages. Finally, a reporting and analytics module provides detailed reports and dashboards, offering insights into payroll costs, trends, and compliance. These integrated modules ensure a smooth and efficient payroll process, minimizing manual intervention and the potential for errors.

Comparison of Payroll System Architectures

Payroll systems are available in various architectures, each with its own advantages and disadvantages. Cloud-based payroll systems, hosted by a third-party provider, offer scalability, accessibility, and reduced IT infrastructure costs. Data is stored securely in the cloud, accessible from anywhere with an internet connection. However, reliance on a stable internet connection and potential security concerns are factors to consider.

On-premise payroll systems, installed and maintained on the company’s own servers, offer greater control over data and security. However, this requires significant upfront investment in hardware, software, and IT expertise for maintenance and updates. The choice between cloud-based and on-premise systems depends on the organization’s size, budget, IT infrastructure, and security requirements. A small business might find a cloud-based solution more cost-effective, while a large enterprise with stringent security requirements might opt for an on-premise system.

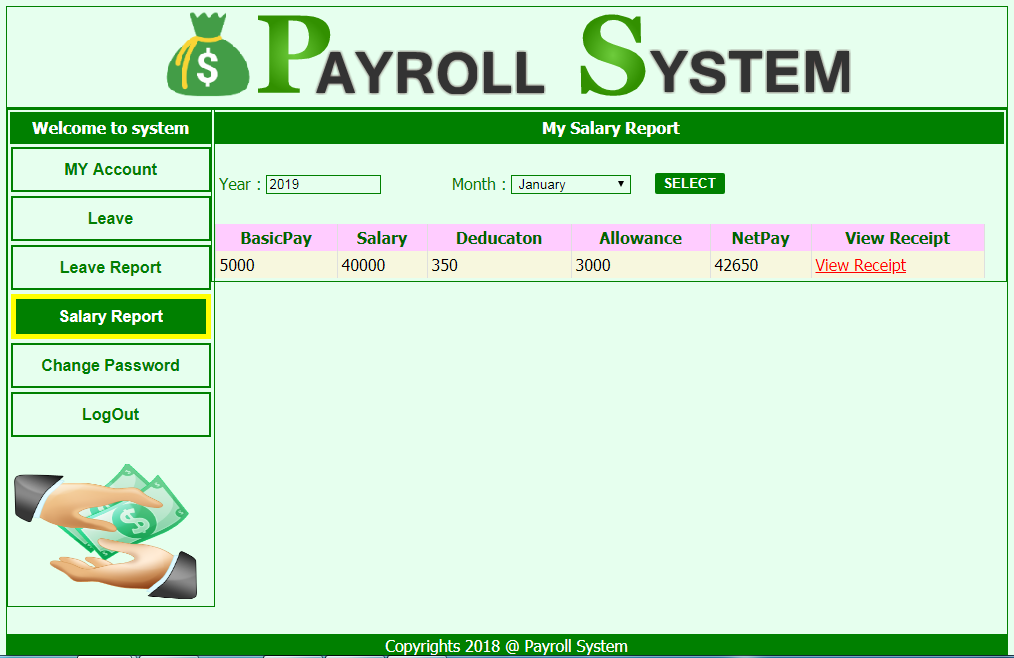

User Interface Design for a Payroll System

Intuitive user interface (UI) design is crucial for a payroll system’s usability. A well-designed UI simplifies data entry, reduces errors, and improves overall efficiency. The system should feature a clean and uncluttered layout, with clear navigation menus and intuitive icons. Data entry forms should be logically organized, with clear labels and input validation to prevent errors. The system should also provide robust search and filtering capabilities, allowing users to quickly locate specific employee data or generate customized reports.

Real-time feedback and progress indicators should keep users informed about the system’s status, and comprehensive help documentation and support should be readily available. A visually appealing and user-friendly interface minimizes frustration and ensures a smooth and efficient payroll process. For example, a color-coded system for flagging potential errors or overdue tasks could greatly enhance usability.

Payroll System Compliance

Navigating the complex world of payroll involves more than just calculating wages; it requires strict adherence to a web of federal, state, and sometimes even local regulations. Failure to comply can result in hefty fines, legal battles, and damage to your company’s reputation. This section Artikels key compliance considerations to ensure your payroll processes are legally sound and ethically responsible.Payroll compliance encompasses a broad range of legal and regulatory requirements, impacting every aspect of payroll processing from calculating wages and withholding taxes to handling employee data and reporting.

Understanding these requirements is crucial for maintaining a compliant and efficient payroll system.

Legal and Regulatory Requirements for Payroll Processing

Payroll processing is subject to a multitude of laws and regulations. These vary by location and often change, necessitating ongoing monitoring and updates to your payroll system. Key areas include federal and state income tax withholding, Social Security and Medicare taxes (FICA), unemployment insurance (UI), workers’ compensation insurance, and potentially other state-specific taxes like disability insurance or personal income tax.

Furthermore, regulations around data privacy (like GDPR or CCPA, depending on your location and employees) must be strictly observed. Staying current with these changes requires dedicated resources and potentially professional payroll services.

Common Payroll Compliance Issues and Their Solutions

Several common issues can lead to payroll non-compliance. Incorrect classification of employees (e.g., misclassifying independent contractors as employees) is a frequent problem, leading to penalties for unpaid taxes and benefits. Another common issue is inaccurate wage calculations, resulting from errors in overtime pay, bonuses, or deductions. Failure to accurately track and report employee hours, particularly for hourly workers, can also lead to significant compliance issues.

Solutions include implementing robust time tracking systems, regular audits of payroll data, and training for payroll staff on relevant laws and regulations. Using a reputable payroll software provider can significantly mitigate many of these risks.

Procedures for Ensuring Compliance with Tax Regulations and Reporting Requirements

Accurate and timely tax reporting is paramount for payroll compliance. This involves correctly withholding taxes from employee paychecks and remitting those taxes to the appropriate government agencies by the established deadlines. Accurate record-keeping is essential, including maintaining detailed records of employee wages, hours worked, deductions, and tax payments. This documentation is crucial for audits and ensures the ability to rectify any discrepancies promptly.

Regular reconciliation of payroll data with tax filings is also vital to detect and correct errors before they escalate. Utilizing payroll software with integrated tax reporting capabilities can streamline this process.

Payroll Compliance Checklist Across Different Jurisdictions

Maintaining payroll compliance across multiple jurisdictions adds significant complexity. A comprehensive checklist is essential to ensure all requirements are met. This checklist would need to be tailored to each specific location, considering variations in tax rates, reporting deadlines, and specific legal requirements. The checklist would include items such as: verifying employee classification in each jurisdiction, confirming compliance with local minimum wage laws, accurately calculating and withholding all applicable taxes, timely filing of all tax returns and reports, and maintaining complete and accurate payroll records.

Professional payroll services often provide assistance with navigating the complexities of multi-state payroll.

Payroll System Cost Analysis

Choosing a payroll system involves more than just features; a thorough cost analysis is crucial for making an informed decision. This section breaks down the various costs associated with implementing and maintaining a payroll system, compares the total cost of ownership (TCO) across different solutions, and explores the potential return on investment (ROI).

Implementation Costs

Implementing a new payroll system involves several upfront expenses. These include the initial software licensing fees, which can vary significantly depending on the size of your company and the features included. For example, a small business might pay a few hundred dollars annually for a basic cloud-based system, while a large enterprise could spend tens of thousands for a comprehensive on-premise solution with extensive customization options.

Additional costs include the time and resources dedicated to system setup, data migration from your old system (if applicable), employee training, and any necessary consulting fees to guide the implementation process. These costs should be carefully budgeted and factored into the overall financial picture.

Ongoing Maintenance Costs

Beyond initial implementation, ongoing maintenance costs must be considered. These include subscription fees (for cloud-based systems), software updates and maintenance contracts, technical support, and potentially the salaries of employees dedicated to managing the payroll system. Some systems offer various levels of support, with higher tiers often costing more but providing faster response times and more comprehensive assistance. For on-premise systems, maintenance might involve server upkeep, software patches, and IT staff time.

Accurately estimating these recurring costs is key to understanding the long-term financial commitment.

Total Cost of Ownership (TCO) Comparison

Comparing the TCO of different payroll systems requires a holistic approach. Consider the initial licensing costs, implementation expenses, ongoing maintenance fees, and the potential cost of downtime or errors. For instance, a seemingly inexpensive system might lead to higher costs down the line due to poor support or frequent errors requiring manual intervention. Conversely, a more expensive, robust system could save money in the long run by reducing errors, improving efficiency, and minimizing downtime.

A spreadsheet comparing these factors across various options will help you make an informed decision.

Return on Investment (ROI) of a Payroll System

The ROI of a payroll system is calculated by comparing the cost of implementation and maintenance against the benefits gained. Benefits could include reduced labor costs associated with manual payroll processing, improved accuracy reducing errors and penalties, increased efficiency leading to time savings, and enhanced compliance minimizing legal risks. For example, a company switching from a manual system to an automated one might experience a significant reduction in payroll processing time, allowing employees to focus on other tasks.

This time saved translates directly into cost savings. Calculating the ROI requires careful quantification of both costs and benefits.

Cost-Benefit Analysis Template

A cost-benefit analysis template should clearly Artikel all expected costs and benefits. This includes a detailed breakdown of initial implementation costs, ongoing maintenance expenses, and anticipated savings from increased efficiency, reduced errors, and improved compliance. The template should also include a timeline for realizing these benefits, allowing for a more accurate ROI calculation. A simple template might include columns for: Cost Item, Initial Cost, Annual Cost, Benefit Item, Annual Benefit, and Net Benefit (Benefit – Cost).

Setting up a payroll system can be a real headache, especially when it comes to tax season. Luckily, there are resources to help; for example, you might find intuit turbotax useful for individual tax preparation, which can indirectly help you understand the tax implications of your payroll choices. Ultimately, a well-structured payroll system is key to avoiding future accounting nightmares.

Using this template, you can compare different payroll systems and choose the option that offers the best return on your investment. Remember to use realistic estimates based on your company’s specific needs and circumstances.

Payroll System Reporting and Analytics

Payroll systems aren’t just about processing paychecks; they’re powerful tools for generating insightful reports and analyzing key performance indicators (KPIs). This data provides valuable insights into your company’s workforce and financial health, allowing for better decision-making and improved efficiency. Understanding these reports and the analytics they offer is crucial for optimizing your payroll process and overall business strategy.

Types of Payroll Reports

A comprehensive payroll system generates a variety of reports, each serving a specific purpose. These reports provide a detailed overview of payroll activity, offering insights into various aspects of compensation and employee data. Some common examples include:

- Pay Registers: Detailed lists of employee payments, including gross pay, deductions, and net pay for a specific pay period.

- Payroll Summaries: Aggregate reports showing total payroll costs, tax liabilities, and other key financial metrics for a specific period.

- Tax Reports: Reports detailing various tax withholdings (federal, state, local) and payments, ensuring compliance with tax regulations.

- Employee Earnings Statements: Individual reports providing each employee with a detailed breakdown of their earnings and deductions for a given pay period.

- Year-to-Date (YTD) Reports: Summarize employee earnings and deductions from the beginning of the year to the current date, useful for tax preparation and performance analysis.

- Cost Allocation Reports: Break down payroll costs by department, project, or other cost centers, aiding in budget management and resource allocation.

Key Performance Indicators (KPIs)

Tracking relevant KPIs is essential for evaluating the efficiency and effectiveness of your payroll process and overall workforce management. These metrics provide a quantitative measure of payroll performance, helping to identify areas for improvement. Examples of KPIs that can be tracked include:

- Payroll Processing Time: Measures the time taken to complete the entire payroll cycle, highlighting potential bottlenecks.

- Payroll Accuracy Rate: Tracks the percentage of error-free paychecks issued, indicating the reliability of the payroll system and processes.

- Cost per Payroll Transaction: Calculates the cost associated with processing each payroll transaction, revealing areas for cost optimization.

- Employee Turnover Rate: While not directly a payroll KPI, it’s often tracked in conjunction with payroll data to understand the cost implications of employee attrition.

- Average Employee Compensation: Provides insights into overall salary levels and benefits costs, aiding in workforce planning and budgeting.

Data Analytics in Payroll Processing

Data analytics plays a vital role in enhancing the accuracy and efficiency of payroll processing. By analyzing payroll data, organizations can identify trends, predict future needs, and improve overall payroll management. For example, predictive analytics can help forecast payroll costs, allowing for better budget allocation. Data mining can reveal patterns in employee compensation and turnover, informing HR strategies.

The use of business intelligence tools allows for the visualization of key payroll metrics, providing a clear picture of payroll performance and facilitating data-driven decision-making.

Sample Payroll Metrics Report

The following table illustrates a sample report showcasing key payroll metrics for a fictional company, “Acme Corp,” for the month of October 2024.

| Metric | Value | Metric | Value |

|---|---|---|---|

| Total Gross Payroll | $150,000 | Average Hourly Rate | $25 |

| Total Net Payroll | $110,000 | Payroll Processing Time | 2 hours |

| Total Tax Withheld | $40,000 | Payroll Accuracy Rate | 99.5% |

| Number of Employees | 60 | Cost per Payroll Transaction | $5 |

Payroll System User Training

Effective payroll system user training is crucial for ensuring accurate and timely payroll processing, minimizing errors, and maximizing the system’s potential. A well-structured training program will equip users with the necessary skills and knowledge to confidently navigate the system and perform their tasks efficiently. This section details various training methods, sample training materials, the new user onboarding process, and a suggested training program for both administrators and end-users.

Training Methods for Payroll System Users

Several methods can be employed to effectively train payroll system users. The optimal approach often involves a blended learning strategy, combining different techniques to cater to diverse learning styles and preferences.

- Instructor-led Training: This traditional method involves a live instructor guiding users through the system’s features and functionalities. It allows for immediate feedback, interaction, and clarification of doubts. This is particularly effective for hands-on training and complex tasks.

- Online Courses and Tutorials: These self-paced modules provide flexibility and convenience, allowing users to learn at their own speed. Interactive elements, such as quizzes and exercises, can reinforce learning. This is ideal for initial familiarization and reviewing specific processes.

- On-the-Job Training: This involves experienced users mentoring new employees, providing practical guidance and support within the actual work environment. This method is beneficial for gaining practical experience and building confidence.

- Video Tutorials and Screencasts: These visual aids can demonstrate specific processes step-by-step, enhancing understanding and retention. This method is excellent for demonstrating complex or visually-oriented tasks.

- Documentation and User Manuals: Comprehensive documentation provides a valuable reference point for users to consult when needed. Well-structured manuals can answer common questions and offer detailed instructions. This is an essential resource for ongoing reference.

Examples of Training Materials for a Payroll System

Effective training materials are crucial for successful user adoption. These materials should be clear, concise, and easy to understand, using a consistent format and style.

- User Manual: A comprehensive guide covering all aspects of the system, including navigation, data entry, reporting, and troubleshooting.

- Quick Start Guide: A concise document providing essential instructions for new users to get started quickly.

- Training Videos: Short videos demonstrating key tasks and workflows.

- Frequently Asked Questions (FAQ) Document: A collection of commonly asked questions and their answers.

- Cheat Sheets: One-page summaries of essential keyboard shortcuts, commands, and navigation tips.

- Practice Datasets: Sample data sets allowing users to practice tasks in a risk-free environment.

Onboarding New Users to a Payroll System

A structured onboarding process is vital for ensuring a smooth transition for new users.

- Account Setup: Create user accounts with appropriate access levels.

- Initial Training: Provide introductory training using a combination of methods (e.g., online modules, instructor-led sessions).

- System Navigation: Guide users through the system’s interface and key features.

- Data Entry Practice: Allow users to practice data entry using sample data.

- Mentorship: Assign experienced users to mentor new employees.

- Ongoing Support: Provide ongoing support and access to resources (e.g., FAQ document, help desk).

Training Program for Payroll System Administrators and End-Users

A comprehensive training program should cater to the specific needs of both administrators and end-users.

Administrators require in-depth training on system configuration, security, and reporting. End-users, on the other hand, need training focused on data entry, processing payroll, and generating reports. A blended learning approach is recommended, incorporating both instructor-led sessions and online resources.

For example, a program might include:

- Module 1: Introduction to the Payroll System (for all users)

- Module 2: Data Entry and Processing (for end-users)

- Module 3: Reporting and Analytics (for end-users and administrators)

- Module 4: System Administration and Security (for administrators)

- Module 5: Troubleshooting and Problem Solving (for all users)

Payroll System Scalability and Flexibility

Choosing a payroll system is a big decision, impacting not just your current needs but also your company’s future growth. A scalable and flexible system is crucial for adapting to changes in employee count, compensation structures, and regulatory requirements. This section explores the key factors influencing scalability and how to choose a system that can grow with your business.Factors Influencing Payroll System ScalabilitySeveral factors significantly impact a payroll system’s ability to scale effectively.

These factors need careful consideration during the selection process to ensure long-term suitability.

System Architecture

A well-designed payroll system should utilize a modular architecture. This allows for the addition of new features and functionalities without requiring a complete system overhaul. Cloud-based systems often offer superior scalability compared to on-premise solutions due to their inherent flexibility and capacity for easy upgrades and expansion. A modular design also simplifies integration with other HR and business systems, reducing complexity and enhancing overall efficiency.

Database Capacity

The underlying database plays a crucial role in scalability. Relational database management systems (RDBMS) are commonly used, and their capacity should be assessed based on projected employee growth and data volume. The database should be able to handle a large number of records efficiently, ensuring fast processing times even with a substantial increase in employee data. Choosing a system with a robust and scalable database is essential to prevent performance bottlenecks as the company grows.

Processing Power and Infrastructure

The system’s processing power and the supporting infrastructure (servers, network, etc.) directly influence its ability to handle large volumes of payroll calculations. Cloud-based systems often provide elastic computing resources, automatically adjusting processing power based on demand. This eliminates the need for significant upfront investment in hardware and ensures consistent performance regardless of employee count. On-premise systems require careful planning to ensure sufficient processing power to handle current and future workloads.

Choosing a Scalable Payroll System

Selecting a payroll system that can adapt to changing business needs involves a thorough evaluation process.

Needs Assessment and Future Projections

Before selecting a payroll system, conduct a comprehensive needs assessment. This involves accurately projecting future employee growth, considering potential changes in compensation structures (e.g., introduction of new benefit plans), and anticipating evolving regulatory compliance requirements. This assessment forms the basis for evaluating the scalability and flexibility of different payroll systems. For example, a company expecting rapid growth should prioritize systems with proven scalability in handling large employee populations and complex payroll calculations.

Vendor Evaluation and Due Diligence

Thorough due diligence on potential vendors is essential. Investigate the vendor’s track record, focusing on their experience in supporting businesses of similar size and complexity. Request references and case studies to assess their ability to handle large-scale payroll processing and system upgrades. Check if the vendor offers flexible pricing models that accommodate fluctuating employee counts. For instance, a pay-as-you-go model might be more suitable for rapidly growing companies compared to a fixed-cost contract.

System Upgrade and Modification

Upgrading or modifying a payroll system is a critical process requiring careful planning and execution.

Upgrade Process

Payroll system upgrades typically involve installing new software versions, applying patches, or integrating new modules. This process should be carefully planned and executed to minimize disruption to payroll processing. Vendors often provide detailed upgrade guides and support services. Regular software updates are essential to maintain system security and performance. Companies should establish a clear upgrade schedule and adhere to the vendor’s recommendations.

A phased rollout approach, starting with a pilot group, can help mitigate risks and identify potential issues before a full-scale deployment.

Modification Process

Modifying a payroll system may involve customizing existing features or adding new ones. This typically requires collaboration with the vendor or internal IT staff. Changes should be thoroughly tested to ensure accuracy and compliance. Detailed documentation of all modifications is crucial for maintaining system integrity and troubleshooting. Changes should be prioritized based on business needs and carefully managed to avoid conflicts with other system components.

Handling Large Employee Counts and Complex Calculations

Designing a payroll system to handle a large number of employees and complex calculations requires specific considerations.

Database Optimization

For large employee counts, database optimization is crucial. This involves techniques like indexing, data partitioning, and query optimization to improve data retrieval speed and overall system performance. Regular database maintenance, including backups and data cleanup, is essential to maintain system stability. The database should be designed to handle large data volumes efficiently, ensuring fast processing times even with a substantial number of employees.

Parallel Processing

Parallel processing techniques can significantly improve the speed of payroll calculations, particularly for large employee populations. This involves distributing the processing workload across multiple processors or servers, reducing overall processing time. Cloud-based systems often leverage parallel processing capabilities to handle large-scale payroll calculations efficiently.

Scalable Architecture

The system architecture should be designed to scale horizontally, allowing for the addition of more servers or processing units as needed. This ensures that the system can handle increasing workloads without performance degradation. A modular design enables incremental scaling, allowing for the addition of resources as needed without requiring a complete system redesign.

Payroll System Vendor Selection

Choosing the right payroll system vendor is crucial for a smooth and efficient payroll process. The wrong choice can lead to costly errors, compliance issues, and significant disruptions to your business operations. This section Artikels key factors to consider during vendor selection, provides a comparison of different vendor types, and offers best practices for contract negotiation.

Key Factors in Vendor Selection

Several critical factors must be weighed when evaluating potential payroll system vendors. These factors ensure the chosen system aligns with your business needs, budget, and long-term goals. Consider factors such as the vendor’s reputation, their offered features, integration capabilities with your existing systems, the level of customer support provided, and the overall cost of implementation and ongoing maintenance.

Security and compliance features are also paramount.

Comparison of Payroll System Vendors

Payroll system vendors range from large, established companies offering comprehensive solutions to smaller, niche providers focusing on specific industries or business sizes. Large vendors like ADP and Paychex offer robust features, extensive compliance support, and nationwide reach. However, they may come with higher costs and less personalized service. Smaller vendors might offer more specialized features or more tailored customer service, but potentially lack the breadth of features or compliance expertise of larger players.

A thorough comparison should consider the size and complexity of your business, your specific payroll needs, and your budget constraints. For example, a small business with simple payroll needs might find a smaller vendor more suitable, while a large enterprise with complex payroll requirements would likely benefit from a larger vendor’s comprehensive capabilities.

Best Practices for Negotiating Contracts with Payroll System Vendors

Negotiating a favorable contract is essential to ensure you receive the best possible value for your investment. Begin by clearly outlining your requirements and budget. Then, compare vendor proposals side-by-side, paying close attention to pricing models, service level agreements (SLAs), and contract terms. Don’t hesitate to negotiate on pricing, contract length, and service features. Clarify all aspects of the contract, including implementation timelines, training, and ongoing support.

Consider including clauses addressing data security, compliance obligations, and exit strategies. For instance, negotiate for flexible contract terms that allow for scaling up or down as your business needs change. Also, ensure the contract clearly defines responsibilities for data security and compliance.

Vendor Evaluation Matrix

The following matrix provides a structured approach to comparing different payroll system options. This allows for a clear and concise comparison of key features and aspects across various vendors.

| Vendor | Features | Cost | Support |

|---|---|---|---|

| ADP | Comprehensive features, robust reporting, strong compliance support | High | Excellent, multiple channels |

| Paychex | Wide range of features, strong compliance, good reporting | High | Good, multiple channels |

| Intuit QuickBooks Payroll | User-friendly, integrates well with QuickBooks, suitable for small businesses | Moderate | Good, online and phone support |

| Gusto | Modern interface, strong benefits administration, good for startups and small businesses | Moderate | Good, online and phone support |

Payroll System Troubleshooting

Dealing with payroll system errors is inevitable, but understanding common issues and their solutions can minimize downtime and ensure accurate compensation for employees. A proactive approach to troubleshooting, including regular system checks and employee training, is key to smooth payroll processing. This section Artikels common problems, their root causes, and effective resolution strategies.

Common Payroll System Errors and Their Causes

Payroll system errors can stem from various sources, including data entry mistakes, software glitches, and integration problems with other systems. Understanding these sources is crucial for effective troubleshooting.

- Incorrect Employee Data: Errors like misspelled names, incorrect social security numbers, or inaccurate tax information can lead to payment discrepancies or compliance issues. This often results from manual data entry errors or outdated information not being updated in the system.

- System Glitches: Software bugs, outdated versions, or server issues can cause unexpected errors, preventing payroll processing or generating inaccurate reports. These are often beyond user control and require IT support or software updates.

- Integration Problems: If the payroll system integrates with other HR or accounting software, issues with data exchange can lead to errors. For example, incorrect time and attendance data from a timekeeping system might result in inaccurate payroll calculations.

- Incorrect Tax Calculations: Changes in tax laws or incorrect configuration of tax rates within the payroll system can result in incorrect tax deductions. Regular updates and verification of tax settings are vital.

- Payment Processing Errors: Problems with bank account details, insufficient funds, or incorrect payment methods can lead to failed payments or delays. Careful verification of employee banking information is necessary.

Solutions for Resolving Common Payroll System Problems

Effective problem-solving requires a systematic approach, combining immediate fixes with preventative measures.

- Data Verification: Double-checking employee data for accuracy is the first step in resolving many payroll errors. This includes verifying names, addresses, social security numbers, and bank account details.

- Software Updates: Keeping the payroll software updated with the latest patches and releases can prevent many system glitches and improve overall performance. Regular updates also often include bug fixes and improved security.

- IT Support: For complex issues or system errors beyond user expertise, contacting IT support or the payroll software vendor is essential. They can diagnose and resolve problems more effectively.

- Tax Rate Verification: Regularly reviewing and updating tax rates within the payroll system ensures compliance with current regulations. This should be done at least annually and whenever tax laws change.

- Payment Reconciliation: Comparing processed payments with employee records and bank statements helps identify and rectify payment errors. This process helps catch discrepancies before they become larger problems.

Troubleshooting Payroll System Issues: A Step-by-Step Guide

A structured approach to troubleshooting significantly improves the efficiency of problem resolution.

- Identify the Error: Clearly define the specific error message or problem encountered. Note the exact details, including any error codes.

- Gather Information: Collect relevant data, such as affected employees, dates, and transaction details. This data provides context for troubleshooting.

- Check Employee Data: Verify the accuracy of employee information, including personal details, tax information, and banking details.

- Review System Logs: Examine system logs for any error messages or unusual activity that might indicate the cause of the problem.

- Consult Documentation: Refer to the payroll system’s user manual or online help resources for troubleshooting tips and solutions.

- Contact Support: If the problem persists, contact the payroll software vendor or IT support for assistance.

Troubleshooting Guide for Common Payroll System Errors

This guide summarizes common errors and their solutions.

- Error: “Invalid Social Security Number.” Solution: Verify the employee’s SSN for accuracy and correct any discrepancies.

- Error: “Insufficient Funds.” Solution: Ensure sufficient funds are available in the company’s bank account.

- Error: “Incorrect Tax Withholding.” Solution: Verify the employee’s W-4 form and update tax settings in the payroll system.

- Error: “System Error: Code 1234.” Solution: Contact IT support or the payroll software vendor for assistance.

- Error: “Payment Failed.” Solution: Check employee bank account details, payment method, and company bank account balance.

Conclusion: Payroll System

Mastering your payroll system is key to smooth operations and happy employees. From understanding its core features and security implications to optimizing integration and ensuring compliance, we’ve covered a lot of ground. Remember, a well-managed payroll system isn’t just about processing payments; it’s about ensuring accuracy, efficiency, and a positive employee experience. By implementing the strategies and insights discussed, you can transform your payroll process from a potential headache into a streamlined, efficient, and secure operation.

Q&A

What’s the difference between gross pay and net pay?

Gross pay is your total earnings before taxes and deductions. Net pay is what you actually take home after those deductions.

How often should I run payroll?

That depends on your company’s policies and employee agreements. Common schedules include weekly, bi-weekly, or monthly.

What are some common payroll mistakes to avoid?

Common mistakes include miscalculating taxes, entering incorrect employee information, and failing to keep accurate records. Using a reputable payroll system can help minimize these errors.

What happens if I make a payroll error?

Correcting payroll errors can be complex and time-consuming. It’s crucial to have a process in place for identifying and rectifying mistakes quickly and accurately to avoid penalties and maintain employee trust.

Can I use a spreadsheet for payroll?

While possible for very small businesses, spreadsheets are generally not recommended for larger companies due to increased risk of errors and difficulty in managing compliance.